Accelerate Exports with Fauree’s Export Finance Scheme (EFS)

Empower your export operations with pre-shipment financing for indirect exporters, all fully digital and fully compliant with the State Bank of Pakistan (SBP) guidelines. Fauree’s EFS solution bridges exporters, suppliers, and banks, enabling early financing, smooth cash flow, and transparent settlement.

Our EFS Solution

SBP-Compliant Pre-Shipment Financing

Fauree’s Export Finance Scheme (EFS) provides short-term working capital to indirect exporters before shipment

Early Access to Funds

Fauree’s Export Finance Scheme provides up to 120 days of pre-shipment financing, with the flexibility to extend to 180 days when needed. This early access to capital means indirect exporters can purchase raw materials, pay workers, and manage production costs well before receiving payment from the direct exporter or overseas buyer.

Strong Cash Flow & Business Stability

With immediate working-capital support, suppliers and manufacturers can maintain a steady cash flow, avoiding the typical financial strain that comes with fulfilling large export orders. The EFS facility enables companies to meet tight production schedules, take on additional export contracts, and negotiate better terms with vendors

Digital Efficiency

Every transaction on Fauree’s platform is fully digital and SBP-compliant, from financing requests and approvals to the submission of delivery evidence and settlement. Real-time monitoring ensures there is no duplicate financing, while built-in checks confirm that all activities align with the State Bank of Pakistan’s Export Finance Scheme guidelines.

why choose fauree for Export Financing - EFS

Pre-Shipment Financing

Up to 120 days, extendable to 180 days.

Flexible Limits

Based on validated export orders and SBP guidelines.

Digital Evidence

Upload and track all documents in real time.

Automated Verification

Reduces errors and ensures timely disbursement.

Continuous Monitoring

Automated alerts keep all parties informed of timelines and compliance requirements.

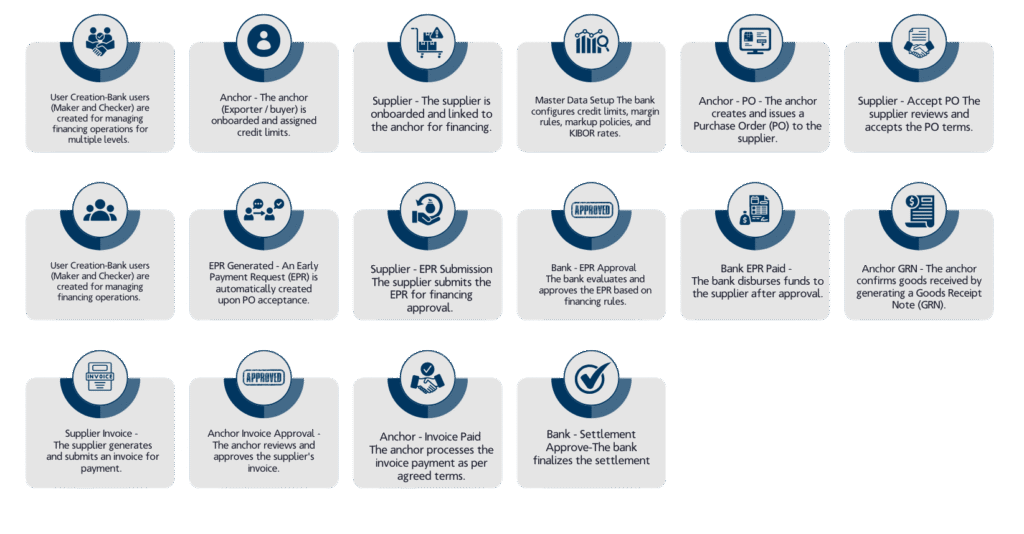

HOW DOES IT WORK

Get Started — Apply for EFS

Ready to accelerate your exports? Contact Fauree today to onboard your business to our Export Finance Scheme (EFS) and experience a fully digital, SBP-compliant pre-shipment financing solution.